There Is Always Risk! Exploiting Change

Cover Definitions LaConte Consulting (800x1200)

Table of Contents

- What is Strategic Risk?

- Why is Strategic Risk Important?

- What are the 6 Types of Strategic Risk?

- How to Identify Strategic Risk?

- How to Manage Strategic Risk?

What is Strategic Risk?

Strategic risk is the risk that an organization's strategy and decisions may not achieve its objectives, resulting in financial loss, reputational damage, or other negative consequences. It is the potential for loss arising from poor or ineffective strategic planning, inadequate decision-making, or external factors such as changes in technology or the economy.Examples of Strategic Risk

Examples of strategic risk include:- Entering a new market without adequate research and analysis

- Releasing a new product without proper testing and quality control

- Over-reliance on a single supplier or customer

- Failure to adapt to changes in technology or consumer preferences

- Changes in government regulations or competitive landscape

Why is Strategic Risk Important?

Strategic risk is important because it can have a significant impact on an organization's financial performance, reputation, and long-term sustainability. Failing to identify and manage strategic risk can result in unexpected losses, missed opportunities, and damage to stakeholder trust and confidence.The Benefits of Managing Strategic Risk

Managing strategic risk can provide the following benefits:- Improved financial performance and stability

- Enhanced strategic decision-making and planning

- Protection of stakeholder interests and reputation

- Increased innovation and agility

- Greater resilience to external threats and challenges

What are the 6 Types of Strategic Risk?

There are six main types of strategic risk:- Operational Risk - the risk of loss arising from inadequate or failed internal processes, systems, or people

- Reputational Risk - the risk of damage to an organization's reputation or brand due to negative publicity or public perception

- Compliance Risk - the risk of legal or regulatory penalties or loss arising from failure to comply with laws, regulations, or industry standards

- Financial Risk - the risk of loss arising from factors such as market volatility, credit risk, or liquidity risk

- Strategic Risk - the risk of loss arising from ineffective strategic planning, decision-making, or execution

- Environmental Risk - the risk of loss arising from external factors such as natural disasters, climate change, or geopolitical instability

How to Identify Strategic Risk?

Identifying strategic risk requires a comprehensive and systematic approach that involves analyzing internal and external factors that could impact an organization's objectives and reputation. Some steps to identify strategic risk include:- Conducting a SWOT analysis to assess the organization's strengths, weaknesses, opportunities, and threats

- Reviewing industry trends, market dynamics, and competitive landscape

- Assessing the organization's internal processes, systems, and people

- Identifying potential risks in the organization's strategic plan and decision-making processes

- Conducting scenario planning and stress testing to identify potential vulnerabilities and exposures

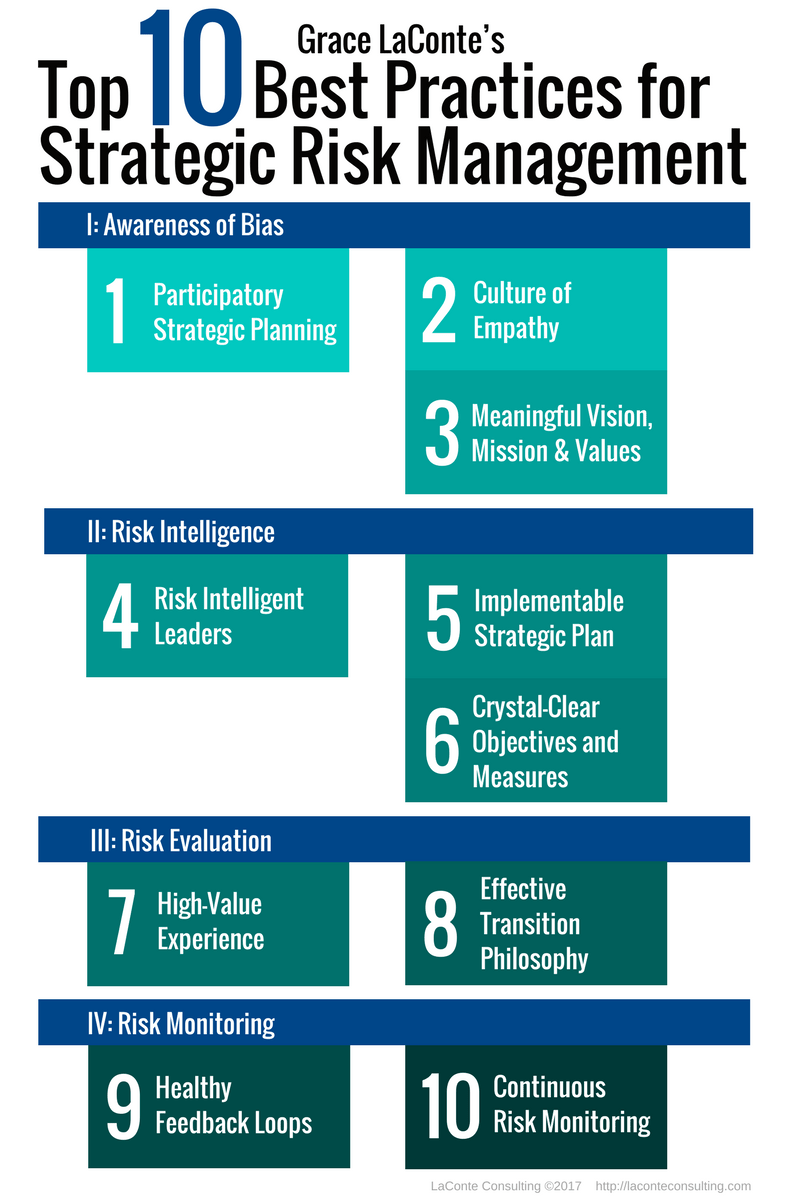

How to Manage Strategic Risk?

Managing strategic risk involves implementing a range of risk management strategies and controls to mitigate or transfer risk. Some steps to manage strategic risk include:- Developing a risk management plan that outlines the organization's risk appetite, risk management strategies, and risk monitoring and reporting processes

- Establishing a risk management framework that includes policies, procedures, and controls to manage strategic risk

- Implementing risk mitigation strategies such as diversification, hedging, or insurance

- Monitoring and reporting on strategic risk to ensure that risk management strategies are effective and aligned with the organization's objectives

- Engaging stakeholders and building a risk-aware culture that promotes transparency and accountability

Post a Comment for "There Is Always Risk! Exploiting Change"